The track record of the hedge and vulture funds that have arrived to Puerto Rico is, in a way, a preview of what the island can expect during and after the contentious negotiation process of its debt.

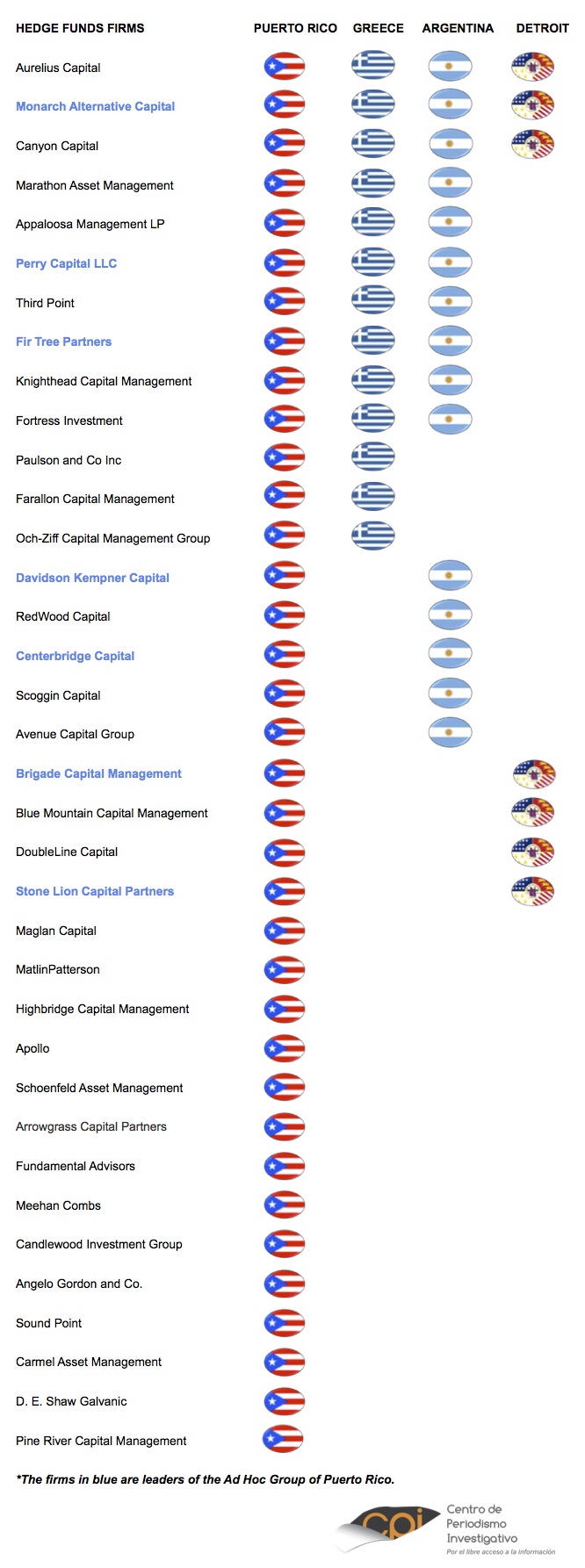

Until now, only a few of the names of the hedge and vulture fund companies referred to as the Ad Hoc Group of Puerto Rico are known, because the group, as well as La Fortaleza and the Government Development Bank (GDB), have refused to reveal the details of its members. The leading firms are Fir Tree Partners, Monarch, Perry Capital, Brigade, Centerbridge, Davidson Kempner, and Stone Lion. That we know.

The Center for Investigative Journalism managed to make a compendium of their profiles and gathered some data on its top executives collected from official documents of the Securities and Exchange Commission (SEC) or from reports mainly published by foreign media.

Foto tomada de http://www.valueinvestorinsight.com

Jeff Tannenbaum, Fir Tree. Photo from www.valueinvestorinsight.com

Fir Tree Partners

Fir Tree Partners’ fortune comes from investments in bankrupt companies and in debt of governments in crisis. In 2012, this company bought part of Greece’s restructured debt. At the end of 2014, they liquidated their fund in Argentina after generating interest gains at 20% for 19 months.

In 2008, Fir Tree joined the hedge funds that are part of the Ad Hoc Group of Puerto Rico to support the investment bank in the Lehman Brothers bankruptcy, an entity that took refuge in Chapter 11 of the Federal Bankruptcy Law, the largest bankruptcy in the history of the United States and a symbol of the global financial crisis. Fir Tree and the group that supported Lehman’s restructuring faced Angelo Gordon, Knighthead and D.E. Shaw hedge fund companies, which were opposed to it. They hold bonds in the Puerto Rico Electric Power Authority (PREPA).

Fir Tree manages close to $8 billion in funds originated in endowments, foundations, public and private pension funds, and investors. They manage, in total, close to 18 private funds; some of them organized under Cayman Island laws, as well as many hedge funds, according to the Securities and Exchange Commission (SEC). Founded by Jeff Tannenbaum, in 2011 Fir Tree was on the Bloomberg’s list of the 100 hedge funds with the most gains.

Foto tomada de Caribbean Business

Julio A. Cabral-Corrada, Stone Lion. Photo published by Caribbean Business

Stone Lion Capital

This company took part in the bankruptcies in Detroit and Jefferson County in Alabama and worked with bond insurers in Puerto Rico’s debt. Among its employees is Puerto Rican Julio A. Cabral-Corrada, a graduate of San Ignacio de Loyola Private School and Cornell University, who then worked at Morgan Stanley’s Equity Trading. Cabral-Corrada collaborated with Puerto Rico in the issuance of $3.5 billion in bonds in 2014 and moved on to form part of the Stone Lion workforce, a firm that handles $2 billion in funds and that set $500 million apart to invest in Puerto Rico’s debt according to Caribbean Business.

Foto tomada de Bloomberg

Richard Perry, Perry Capital. Photo published by Bloomberg

Perry Capital

Besides being part of the Ad Hoc Group of Puerto Rico, Perry Capital has invested in private companies operating in Puerto Rico, such as Dade Paper, Rock-Tenn and KapStone Paper and Packaging. In 2007, Perry Capital invested in Doral Bank, in a recapitalization process in which D.E. Shaw, Canyon Capital and Goldman Sach participated. In 2008, the founder of Perry Capital, Richard Perry, had a personal fortune of $1.2 billion. Perry Capital manages more than $11 billion in funds.

Tomado de www.monarchlp.com

Andrew Herenstein, Monarch Alternative. Photo from http://www.monarchlp.com/

Monarch Alternative

This company made large profits in sovereign debts in Europe, investing in countries such as Greece, Spain, and Portugal. It manages more than $5 billion in funds and owns $499 million in stocks. As with many hedge fund companies, Monarch Alternative holds funds organized under the laws of the Cayman Islands. Its founding directors are Michael Weinstock and Andre J. Herestein. Herestein shared a The New York Times article on Twitter, in which Governor Alejandro García Padilla declared that Puerto Rico’s debt is not payable under the current conditions and follows such diverse people as Joseph Stiglitz, economist, Benjamin Netanyahu, Israel’s Prime Minister, and Eduardo Bahtia, President of the Puerto Rico Senate.

Tomado del Wall Street Journal

Thomas Lenox Kempner, Davidson Kempner. Photo fom the Wall Street Journal.

Davidson Kempner Capital Management

The Davidson Kempner firm manages approximately $25.4 billion. Between 2012 and 2013, this company increased its capital form $1.6 billion to $18.5 billion. It has invested in risk debts such as bonds in Lehman Brothers, the governments of Greece and Argentina. It joined the Ad Hoc Group of Puerto Rico in August 2014.

Foto de Alex Wong/Getty Images

Mark-Gallogly, Centerbridge. Photo from Getty Images.

Centerbridge Partners

The majority of the investments made by Centerbridge are centered on acquiring companies that are undergoing bankruptcy or financial restructuring. It owns a large part of the debt of a subsidiary of Energy Future Holdings Corp., a private company in Texas that took refuge in bankruptcy protection last year. Centerbridge could keep a significant part of the subsidiary. This company manages close to $25 billion in funds. One of its co-founders, Mark Gallogly, is a member of President Obama’s Economic Advisory Board.

Foto tomada de www.pionline.com

Donald Morgan, Brigade Capital. Photo from www.pionline.com

Brigade Capital

This firm manages close to $14 billion in funds. It employs various investment strategies, like contacting with company directors where they plan to invest, analyze its composition, financial position and its status in reference to regulatory standards. Its directors are Patrick William Kelly and Donald Ellis Morgan III.

More hedge funds with bonds in Puerto Rico

Although not necessarily part of the Ad Hoc Group, these other hedge funds companies are also in Puerto Rico and their path marks the route that could be followed in Puerto Rico.

By Laura Moscoso, Joel Cintrón and Carla Minet | Center for Investigative Journalism

Aurelius Capital

This firm handles $3.4 billion in funds and is one of the firms that has an ongoing litigation against the government of Argentina in the New York court, demanding payment of $1.3 billion. Aurelius has also pressured the total payment of Greece’s debt and was opposed to the restructuring of the debt of that country in 2012. The director of Aurelius Capital, Mark Brodsky, a bankruptcy attorney, has made his fortune from crisis situations, according to The Telegraph, in an article that describes how Aurelius took control of United Kingdom Cooperative Bank in 2013.

In the case of the Co-op, Brodsky recognized that the price of its debt was too low. He bought-in, with analysts saying the bank was unlikely to be allowed to go under. And in the absence of a bankruptcy, there was a good chance creditors could insist on getting their dues paid, almost in full. Rather than accept the £500m “haircut” in the debt they were owed, Brodsky and his fellow hedge funds refused to play ball. The law was on their side, and they won, with the spoils being stakes of about 10 per cent in the business. Each.

Och-Ziff Capital

This firm opposed financial rescue and restructuring agreements of the debt in Greece, with the goal of achieving higher gains, according to The Independent. Och-Ziff Capital was also accused of spreading false rumors directed at Lehman Brothers financial service company. The firm is one of top companies of its kind in the world. In March 2015, it had $47.9 billion in capital under its management. In 2014, it held the fourth spot of the 100 largest hedge funds firms in the world, according to a list published by Institutional Investor. Its executive director and founder, Daniel S. Och, has a net fortune of $2.3 billion.

DoubleLine Capital

DoubleLine bought $20 million in bonds in the Puerto Rico Retirement System. In March, DoubleLine managed $73 billion in funds; Puerto Rico’s bonds are 1% of this total, according to Reuters. Jeffrey Gundlach, DoubleLine’s CEO, is referred to as “the king of bonds,” and his fortune’s net worth is $1.08 billion. In the Sohn Investment Conference in New York, held in May, Gundlach said the Governor of Puerto Rico “is committed to pay the total of the debt on time.” Although he failed in that prediction, he recently told Reuters that, if the price were enticing, he would continue purchasing Puerto Rico municipal bonds.

Fortress Investment Group

In July 2014, Debtwire informed that Fortress and other hedge fund companies were trying to take a more active role facing a possible restructuring of the debt acquired by the government of Puerto Rico. Fortress manages $69.9 billion. In 2010, it acquired 80% of American General Finance, providers and consolidators of personal and commercial loans, which has as borrowers millions of families in Puerto Rico, United States, U.S. Virgin Islands and the United Kingdom.

It joined Parkfield Capital Advisors to form Acrecent Financial Corporation of San Juan, a joint venture that invests in medium-sized companies in the island. “The economic agitation in Puerto Rico in the last few years has left many local companies with limited access to capital markets,” said Andrés Pinter, president and Parkfield delegate advisor. The directors of Acrecent are Raúl H. Cacho, former vice -president of Banco Popular and James Conner, ex–president of GE Capital, a financial service unit of General Electric.

Paul Stockamore, Senior Vice-President of Fortress, attended the 2015 Puerto Rico Investment Summit. His salary is approximately $145,457 plus $52,137 in cash rewards; his annual earnings total $197,594, according to Glassdoor.

Canyon Capital

Canyon Capital and its affiliates manage more than $23 billion in funds and have more than 200 employees, including 100 investors in its team. The co-founder of Canyon Capital, Mitchell Julis, has been number 25 in a list of the 50 richest hedge fund directors in the Hedge Fund Journal. His first job after graduating from Harvard Law School was as a bankruptcy attorney in New York. Afterwards, he worked with economist Michael Milken, known as “the father of junk bonds.” In 1990, he founded Canyon Capital with Joshua Friedman, an ex-banker at Goldman Sachs, who also appears on the list of the richest hedge fund directors. Both of them made $150 million in 2013, according to Forbes. In 2011, Canyon joined Agassi Venture to invest in the construction of charter schools in the United States; an investment that they expect will generate between $300 million and $50 million in profits, and opened their first school in 2012.

Maglan Capital

This firm manages $60 million and competed for Puerto Rico’s debt and has bought bonds since 2013. Maglan concentrated on investing in companies with economic difficulties in the United States but the low values in Puerto Rico and “the steps taken by the Governor to close the gap in the budget” attracted Maglan to invest for the first time in municipal debt. David Tawil, founder of Maglan, expressed optimism in Puerto Rico. In 2013, he said: “Over the next two years, the government should be able to make progress in their plans”. “They will do a lot of fundamental changes; they will be seen as a reforming story, so that debt should trade up substantially.”

D.E. Shaw & Co.

E. Shaw hold bonds in PREPA and agreed in delaying the payment of $5 billion from the corporation last June, but is demanding total payment of the debt along with 11 other firms. It participated in the struggle for the remains of Lehman Brothers investment bank and was opposed to its restructuring. It is a global firm with more that $36 billion in invested capital. The personal fortune of its founder, David Shaw, was near $2.2 billion in 2011.

Marathon Asset Management

This firm manages $10 billion in capital and has been purchasing bonds of Puerto Rico’s debt since 2013. Bruce Richard, director of Marathon, said in June that PREPA could avoid restructuring if it accepted a plan that included an injection of $2 billion to stabilize the public corporation. In 2013, Richard told Bloomberg that, “Marathon maintains the position that PREPA does not need restructuring, that it is a corporation with valuable assets if it was slightly more efficient and built its own power plants on the island.” He also mentioned that it had been a good idea to invest in PREPA. Marathon is of one the hedge fund companies accused of impeding the financial rescue of Greece in 2012.

Avenue Capital

In its 2014 annual report, the firm declared that it holds $1.1 million in bonds in Puerto Rico that mature in 2035. One of the founders of Avenue, Sonia Gardner, has a fortune of $380 million. Marc Lasry, Gardner’s brother and co-founder of Avenue, has a net fortune of $1.3 billion. Lasry raised funds for Barack Obama in 2012 and Hillary Clinton during the 2008 Democrat primary. Chelsea Clinton worked for Avenue Capitol. This firm estimates that it manages $12.9 billion in funds.

Candlewood

Candlewood manages $2.9 billion in funds and in 2014 the investor group found Puerto Rico’s debt attractive since it could yield high profit. They decided to focus on selecting bonds issued by the government of Puerto Rico and its public corporations, which could include infrastructure bonds backed by alcohol taxes and general obligation bonds. Company representatives said they have been doing extensive research on Puerto Rico since 2013. The minimum investment they required to join their concentrated fund in Puerto Rico was $250,000.

Sound Point Capital

Steve Ketchum, executive director of Sound Point, told Bloomberg that in Puerto Rico, “there are no obvious great economic difficult situations… We are comparing Puerto Rico with some of the worst situations of sovereign debt in history and it simply does not make sense to us, especially since Puerto Rico is a territory of the United States.” In March 2015, Sound Point managed close to $6.5 billion in funds in institutions, pensions, foundations, insurance companies, and individuals.