The investment companies that hold Puerto Rico government bonds have been grouping together in different clans to defend their interests in the debt negotiation process led by Alejandro García Padilla’s administration.

The investment companies that hold Puerto Rico government bonds have been grouping together in different clans to defend their interests in the debt negotiation process led by Alejandro García Padilla’s administration.

There are many types of debts with different payment dates that are held by several investment companies on the island, some with shared interests and others with differences in regards to which political decisions will favor their return.

Those companies that are attempting to collect payment of part of the debt, such as the big hedge fund companies, as well as mutual funds and bond insurance companies, have already hired law firms specializing in bankruptcy and restructuring governments in crisis.

Sources in the financial sector interpret the hiring of these law firms as a message to the government of Puerto Rico: they are going to exert aggressive pressure to collect the totality of the debt with interest.

At least four hedge fund and mutual fund company clans have been formed that hold government bonds. The possibility of a joint negotiation of the government debt is very complex in this scenario. However, Melba Acosta, president of the Government Development Bank (GDB), is confident that it is doable.

Knowing how these companies performed in other countries such as Greece or Argentina, or in Detroit, can you have the real expectation that this negotiation is possible? “Well, there are meetings going on in PREPA (Puerto Rico Electric Power Authority, PREPA) right now. The bondholders are difficult, very difficult. But it’s happening. We are moving slowly. We haven’t finished, but…remember that what is important to them is to get back everything they have invested. The only thing that the PREPA bondholders can request from the court is a trustee,” noted the official, who insisted that the PREPA negotiation process would be the model to follow with the rest of the bondholders.

On the other hand, Carlos Gallisá, the PREPA public interest representative, has a different point of view. “The PREPA negotiation could be an indicator of what can happen in Puerto Rico’s negotiation. It’s true. There are bondholders that are on both sides, in PREPA and in the central government’s debt. There is no indication at this time that PREPA has moved forward in the negotiation or that it has opened to the possibility of reaching an agreement soon. It could take months. At best, at this moment, the four month extension of Lisa Donahue’s contract (PREPA restructuring official), those who favored the contract, may be acknowledging that (reaching an agreement) may take at least four months,” he told.

The Clans and their law firms

The Clans and their law firms

The investment companies have grouped into clans based on the debts they are trying to collect. For example, there are companies that hold GDB bonds, General Obligation bonds (GO’s), the Puerto Rico Sales Tax Financing Corp. (COFINA), or from PREPA. There are other companies that hold bonds from several of these entities at the same time and, therefore, belong to more than one clan. This situation has provoked conflicts of interests within the firms that belong to one group.

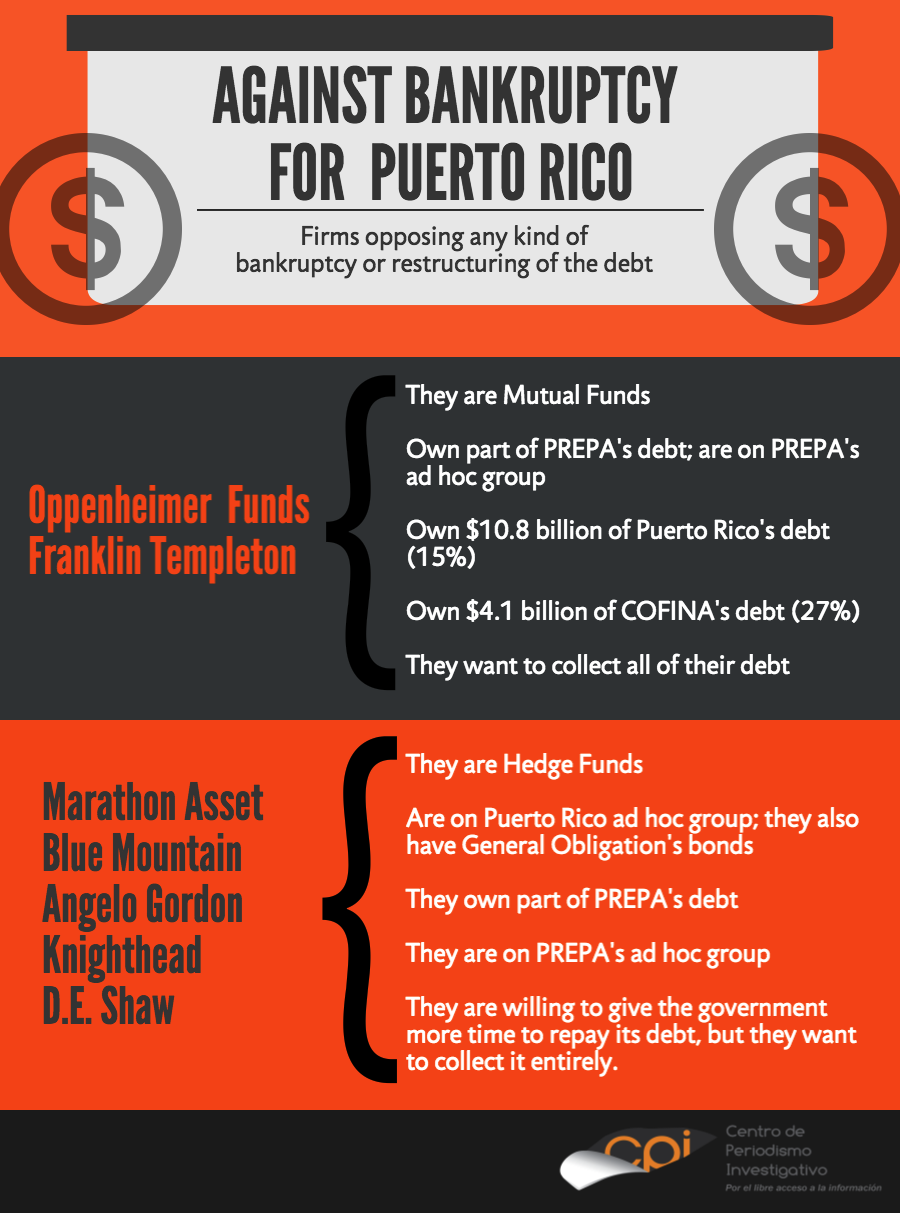

Additionally, the companies are also divided between those that support the restructuring of the debt and those that do not.

Some hedge funds firms believe that if the Puerto Rico government gets a restructuring process for public corporations, it could use that money from the General Fund to pay the GO’s that they own, which are constitutionally guaranteed. They also bet on this process as a trigger for prices to go up in the stock market. That is why they support the restructuring process, according to CPI sources.

But, those companies that hold public corporations bonds, as well as hedge and mutual funds, are opposed to restructuring the debt because reorganization could imply delays and cuts in the payments that expect to receive.

The PREPA Ad Hoc Group

One of the clans, the only one that is actually at the negotiating table is the PREPA Ad Hoc Group. The hedge fund members are Angelo Gordon & Company, Blue Mountain Capital, D.E. Shaw Galvanic Portfolios, Knighthead Capital, Marathon Asset Management and Franklin mutual fund. This group hired the Venable Law Firm. Blue Mountain, on its part, also recruited the Gibson Dunn Law Firm. Both law firms have been lobbying against Project HR-870, petitioned by Resident Commissioner Pedro Pierluisi, that seeks to extend Chapter 9 of the Federal Bankruptcy Law to Puerto Rico.

The Franklin Fund has also been exerting pressure in Congress against Pierluisi’s HR-870 bill with Oppenheimer, another mutual fund, represented by the Kramer Levin Naftalis and Frankel law firm. Together, these two funds hold $10.8 billion of the government debt (Oppenheimer holds $7.4 billion and Franklin holds $3.4 billion). The data on the total amount of the debt held by these firms is not official and was published by The Wall Street Journal, after analyzing the information available on the Morningstar specialized platform.

The Oppenheimer and Franklin mutual funds have been investing long term for close to 20 years in Puerto Rico and are pressuring the PREPA negotiation to collect all, since they paid for their bonds close to 100 cents per dollar before 2013, much more than other investors.

Meanwhile, there is a group that is more willing to negotiate: those hedge funds that started short-term investments in 2013 and bought bonds at 40 to 50 cents per dollar. They could still profit even if the government was able to get a discount on the debt of 10 to 20 percent, for example, sources from the industry pointed out to the CPI.

There are other bond insurer companies also against restructuring PREPA and other entities, since they would have to compensate for any delay or reduced payment. The main bonds insurers (monoline insurers) of Puerto Rico are, Assured Guaranty, National Public Finance Guarantee and Ambac Assurance. Some of these insurers have hired Cadwalader, Wickersham & Taft, Weil, Gotshal & Manges and Debevoise & Plimpton Law Firms to represent them.

Ad Hoc Group of Puerto Rico

The Ad Hoc Group of Puerto Rico owns $4.5 billion in GO’s, BGF, and COFINA bonds, according to the financial press. Led by vulture funds Fir Tree Partners, Monarch, Perry Capital, Brigade Capital, Centerbridge Capital, Stone Lion, and Davidson Kempner; this group has been in operation for a year on the island and hired the Robbins, Russell, Englert, Orseck, Untereiner & Sauber law firm.

This law firm has as clients companies that are part Fortune 500 corporations that hold top positions this year, such as Walmart, Exxon Mobil, and Apple. This law firm announced on their Internet page that among its habitual clients are hedge funds companies.

The law firm has represented vulture funds Aurelius Capital, Blue Angel – an affiliate of Davidson Kempner fund and Elliott Management, owned by multimillionaire vulture funds manager Paul Singer, against the government of Argentina, in the debt repayment case against that government to be decided in the New York Court. The Ad Hoc Group of Puerto Rico has also hired to serve as an advisor, Claudio Loser, Argentinian ex-director of the International Monetary Fund and founding executive of Centennial Latinoamérica.

The Ad Hoc Group of Puerto Rico, whose spokespersons, besides government officials, have hidden the identity of many of its members, have been sending smoke signals to the Fortaleza and the BGF to start the negotiations. “They sent a letter stating – we want to do this with you- — and I don’t know what else, and my response was — we are going to make the Krueger report public and then we will sit down and talk,” said Melba Acosta, in reference to the report done by Anne Krueger, economist, about Puerto Rico’s economic and fiscal situation. Acosta admitted to having met with these firms on several occasions, but insists that she cannot recall their names.

So, intrigues and communications between the government and the bondholders are treated under the radar. For example, one of the sources of the CPI said that one of the lobbyists that represent the Ad Hoc Group of Puerto Rico is Roberto Prats, former senator and chairman of the Democratic Party in Puerto Rico, whose firm is RPP Consulting Group LLC. When CPI asked Prats about the firms he represents, the answer was: “While I appreciate your interest in this matter, private agreements between my firm and our clients prevent me from revealing the information you request.”

BGF Ad Hoc Group

Another group of BGF debt bondholders is composed of, at least, five investment companies: Avenue Capital, Brigade Capital, Candlewood Investment Group, Fir Tree Partners and Perry Corp. Fir Tree Partners, Brigade, and Perry Corp are also members of the Ad Hoc Group of Puerto Rico. The BGF bondholders’ clan hired Davis Polk & Wardwell Law Firm. This law firm indicates on their Internet page that they have experience in representing and advising the largest hedge funds companies of the United States and in the world. They also collaborated with the United States government in high-profile cases related to the 2008 financial crisis, such as the financial rescue of the American International Group (AIG).

COFINA Ad Hoc Group

Another clan is composed of, at least, five companies, whose identity has not been made public but specialized media has reported that owns $5 billion together in COFINA bonds, has hired Quinn Emanuel Urquhart & Sullivan law firm. Some of the companies holding COFINA bonds have not been accepted in this group to avoid conflict of interests since they also hold bonds in other corporations, according to The Wall Street Journal. CPI sources indicated that within this group, there are members of the Ad Hoc Group of Puerto Rico.

The 27% of COFINA’s debt is in the hands of Oppenheimer and Franklin Mutual Funds, and they hold together $4.1 billion of the $15 billion total debt owed by that corporation, according to The Wall Street Journal’s analysis of the data provided by the Morningstar service.

Graphics by Laura Moscoso