English

Puerto Rico Board Members Were Evaluated Without Defined Criteria, Before PROMESA Was Signed

by Luis J. Valentín Ortiz |

Puerto Rico Board Members Were Evaluated Without Defined Criteria, Before PROMESA Was Signed

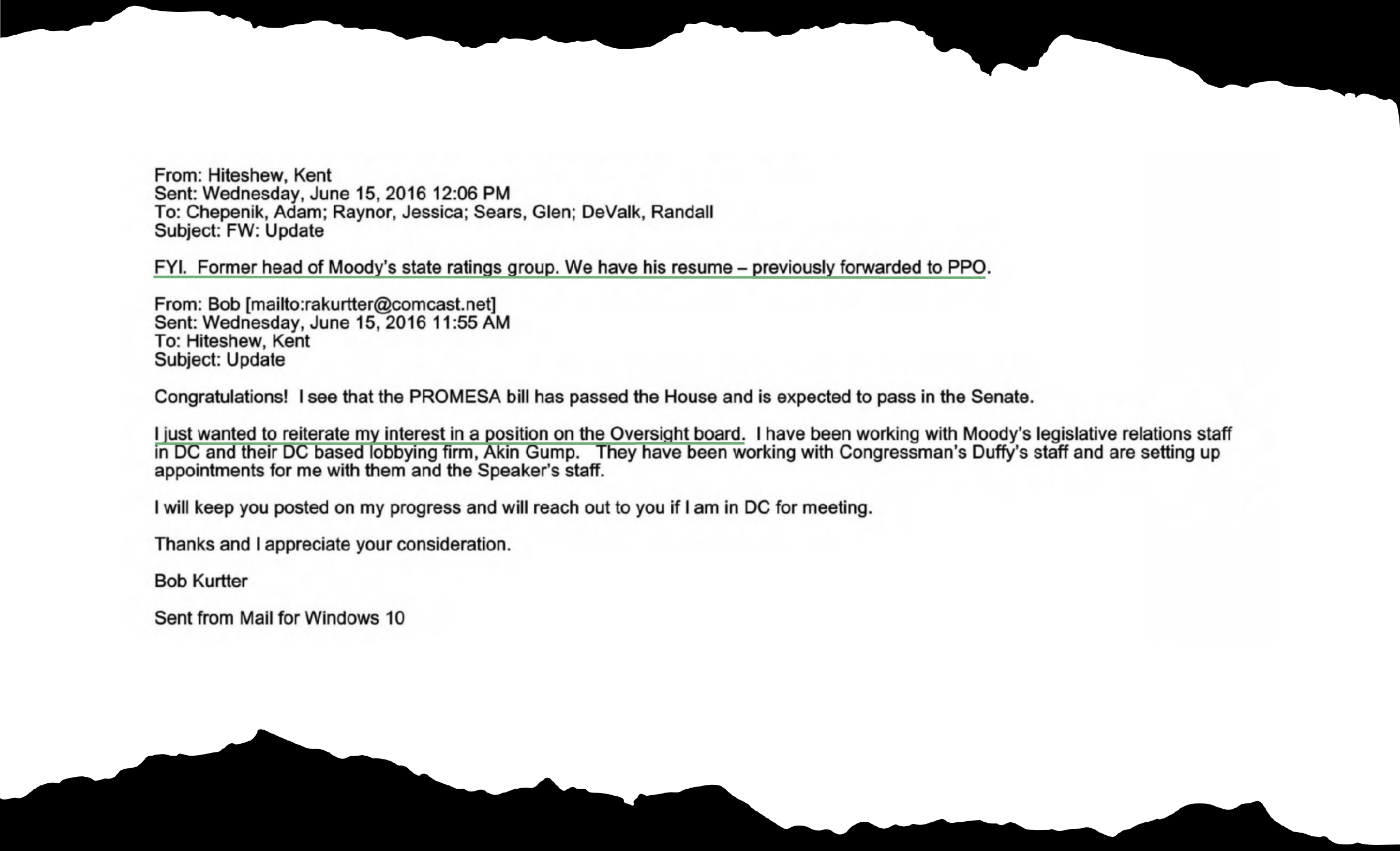

On the morning of June 15, 2016, an email arrived at the U.S. Department of the Treasury congratulating a high-level official for the approval in the U.S. House of the PROMESA bill, which imposed a Fiscal Control Board in Puerto Rico.

“I just wanted to reiterate my interest in a position on the Oversight Board,” wrote Robert Kurtter, a financial analyst who had been retired for a year from the credit-rating agency Moody’s. He had directed the public finance division there, the same one that classified Puerto Rico’s debt as junk, a key element for the establishment of the Board to which he wanted to belong.

In his message, Kurtter assured that through Moody’s and Akin Gump, the agency’s lobbyists in Washington, D.C., he would get meetings in Congress to obtain his nomination with the staff of former Republican Congressman, Sean Duffy, and the then Republican Speaker of the House, Paul Ryan.

Kent Hiteshew, then director of the Treasury’s Office of State and Municipal Public Finance, received Kurtter’s email. He shared it with part of his team with a message: “FYI. Former head of Moody’s state ratings group. We have his resume — previously forwarded to PPO [Presidential Personnel Office].”.

.

When asked by the Center for Investigative Journalism (CPI, in Spanish), Kurtter said although he had strong credentials to serve on the Board, the appointments were “political in nature” and he never had political support in Congress. He denied that his interest represented a conflict since Moody’s “is recognized world-wide,” that the firm does not buy or sell bonds, that it was the government of Puerto Rico and not the Board that issued debt, and that at that time, he had already retired. He claimed that he was never contacted for an interview and that his candidacy ended there.

“I do not have any knowledge of a process for candidate evaluation, although I imagine that one existed,” Kurtter added.

More than 3,100 pages and documents now allow us to know how the first seven members of the Fiscal Control Board were chosen, after being obtained by the CPI as part of a lawsuit under the Freedom of Information Act (FOIA) against the U.S. Department of the Treasury, which remains active. The email messages and attachments show an informal process, which began months before the approval of the PROMESA law, and in which around 20 officials from the U.S. Treasury and the White House during the Barack Obama administration chose and recommended candidates without clearly defined selection criteria.

In total, more than 115 people were considered during the first round of appointments, the federal agency revealed to CPI.

On August 30, 2016, more than a month after the original plan, the Obama administration made public the appointment of the first seven members of the Board: José Carrión, Carlos García, José Ramón González, Ana Matosantos, Arthur González, David Skeel and Andrew Biggs.

Seven years after that first round of appointments to the Board, the Treasury no longer has the control it had of the Board, nor does it lead the selection process of its members, like in the beginning.

The administration of current President Joseph Biden, following the recent appointment of Juan Sabater, can fill another vacancy and replace, if desired, any of the other five current members. Doing so could change the ideological balance of the Board, in an election year and with a Democratic majority in the Senate.

The PROMESA law was the U.S. Government’s response to the fiscal crisis that Puerto Rico faced in the past decade. The Treasury and Congress designed a bankruptcy mechanism for Puerto Rico and its other territories, but it was conditioned on the imposition of a Fiscal Control Board. This entity has broad powers over the elected government, including approving the island’s budget, and its members are appointed from Washington, D.C., by the President and congressional leaders, although its multimillion-dollar operation is paid for with funds from the government of Puerto Rico.

Since its inception in September 2016, operating the Board has cost the Puerto Rico coffers more than $400 million, according to the entity’s audited financial statements. When adding the expense of lawyers and consultants for issues related to the bankruptcy case under PROMESA, the figure exceeds $1.5 billion, making Puerto Rico’s bankruptcy the largest in the history of the United States’ municipal bond market.

Biden Administration is also secretive about the process

As of press time, questions sent to the Treasury and the White House about the process they are following for new appointments and what criteria they take into consideration when evaluating candidates were not answered.

The CPI also directly contacted several of the original Board members with questions related to their appointments but did not receive a response from any of them.

Although the Board was not asked for a reaction, its communications director, Matthias Rieker, wrote: “We are aware that you have contacted certain board members with questions about their appointment process. On their behalf, please note that the Oversight Board declines to comment.”

Currently, the Board is composed of three Republicans, Skeel, Biggs and John Nixon, and three Democrats, Arthur González, Betty Rosa, and the newly appointed Juan Sabater.

A week after the CPI questioned the White House about when it would make the new appointments and whether they have followed the same process as in 2016, the Biden administration announced Sabater as the nominee chosen directly by the President.

Sabater, who works for investment firm Valor Equity Partners, fills the vacancy left by Justin Peterson, who was appointed by President Donald Trump in 2020 and resigned in August 2023.

A week before Sabater’s appointment, the Board told CPI it did not have any information about new appointments and assured that its work continued without setbacks despite the vacancies.

Robert Mujica, executive director of the Fiscal Control Board.

Photo by Ricardo Arduengo | Center for Investigative Journalism

“The way the law works is, and this is not unusual for appointments across the federal government, generally speaking, if the term expires, the board members stay in place until they’re replaced. So, for our purposes, it doesn’t create any instability. We continue going without a hiccup until someone is replaced,” the Executive Director of the Board, Robert Mujica, told the CPI a few months ago.

The remaining vacancy on the Board would be filled with someone from the list proposed by Senate Majority Leader, Democrat Charles Schumer.

Treasury remains mum on who it considered for the Board

In early 2017, after then Board chairman, José Carrión, said during the first public meeting that the Treasury had followed a “rigorous process” of evaluation, the CPI requested all communications related to the evaluation and selection of Board members from the Treasury, a closed-door process about which very little is known. More than five years later, and after a lawsuit filed under the FOIA that remains active, the Treasury turned over 3,188 pages, most of them completely redacted.

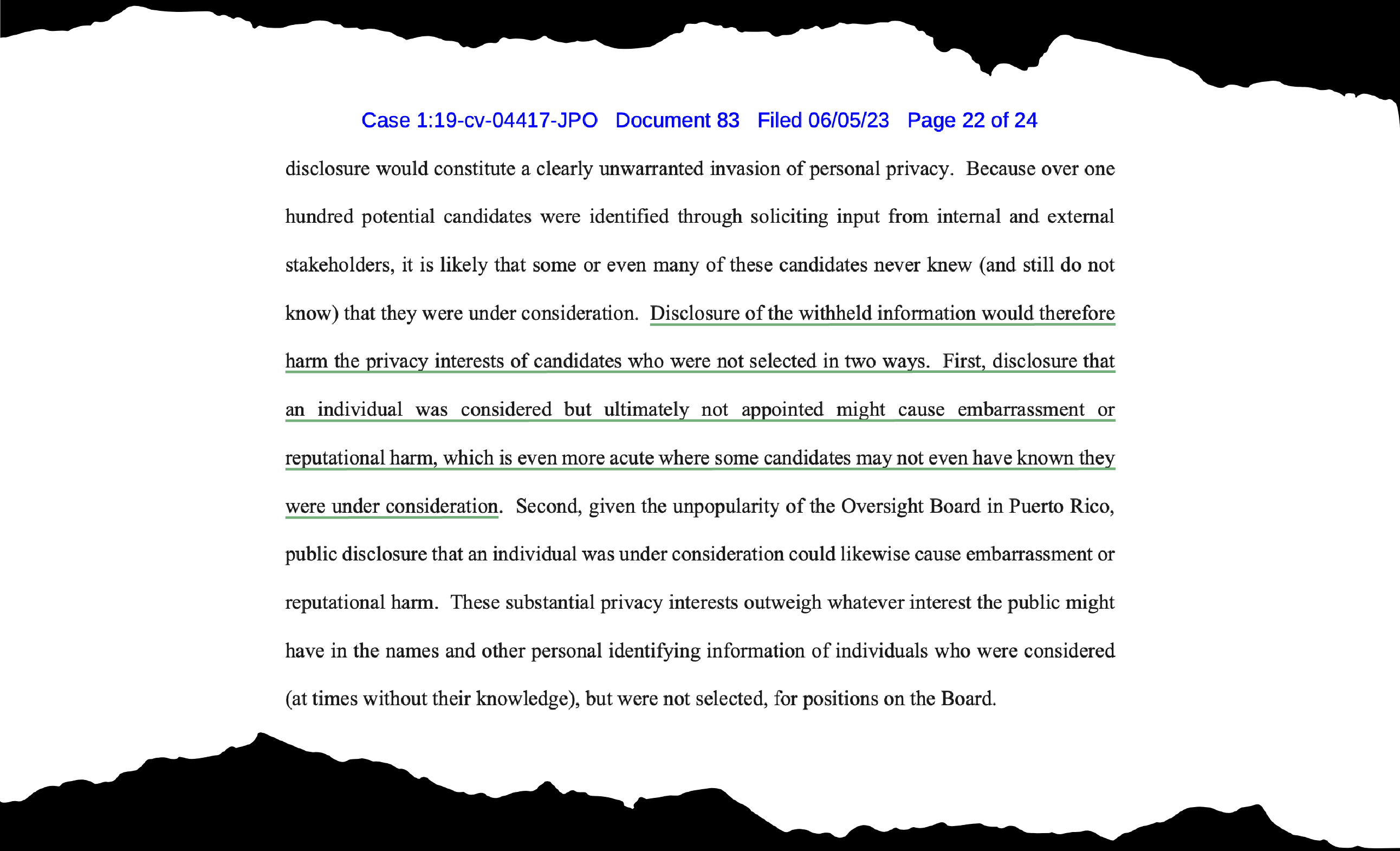

The agency refused to reveal the names of the candidates considered but not selected since, as it argued before a federal court, this would cause professional embarrassment and reputational harm to those people. The embarrassment would be so great that it would represent an unwarranted invasion of their personal privacy, the Treasury alleges.

The federal agency added that the Board “has met with significant disapproval in Puerto Rico” and that it continues to be “deeply unpopular.”

A CPI review found that the Treasury only revealed two names of people who were considered but not selected: Kurtter and Sergio Marxuach, director of Public Policy at the Center for a New Economy, a think tank in Puerto Rico. Although according to one of the emails he initially rejected the approach, Marxuach later agreed to start the vetting process with the intention of being appointed to the Board, after being recommended by Democratic Congresswomen Nancy Pelosi and Nydia Velázquez.

“We had a call and then nothing,” Marxuach told CPI, referring to a telephone conversation with U.S. Treasury personnel. He said he never knew what the evaluation criteria were, nor the process they followed to finally rule him out as a candidate.

He recalled that during the call, what they were most interested in was how much time he could dedicate to the Board if he was chosen.

“If they’re going to do it [create the Board], maybe being inside I could do something so that it isn’t that bad,” said the economist about why he agreed to be considered for the Board, despite his public opposition to the entity.

The CPI case against the Treasury is still pending a decision by the U.S. District Court for the Southern District of New York regarding the confidentiality of the names of those people considered, but not selected to be on the Board. While the CPI assures that there is a high public interest in knowing who was considered and rejected to belong to the Board, the Treasury alleges that this information is protected under the deliberative process privilege and disclosure would constitute an unwarranted invasion of their personal privacy.

PROMESA established a selection process in the summer of 2016 for the seven seats on the Board, which at that time involved choosing two of six candidates from a list that would be presented by the then Speaker of the House, Republican Paul Ryan, two others from that of his counterpart in the Senate, fellow Republican Mitch McConnell; one from House Minority Leader Democratic Rep. Nancy Pelosi; and another from Democratic Senator Harry Reid, Senate minority leader. A seventh member would be appointed by Obama.

The President would receive these names, choose his favorites from each list, a process of evaluation, or vetting, of the finalists would begin, and then they would be officially named and announced.

But by the time the law was approved on June 30, 2016, the Treasury and White House group, from its Office of Presidential Personnel and the National Economic Council, had already been considering names for the Board since April of that year, according to the emails disclosed. That team prepared and shared lists of candidates for the Board based on recommendations from different sources that are now known: from Democratic and Republican politicians to bondholder groups, unions, Governor Alejandro García Padilla and the then Resident Commissioner Pedro Pierluisi, and people with connections in the federal government.

As part of the CPI case, Treasury admitted that it requested names from “other interested groups” and said although the final decision came from congressional leaders, the agency suggested names for their lists and told them who they should include and who they should not, based on the Treasury’s evaluation. It described the deliberation process as one of a “unique nature,” through which they exchanged “candid” opinions, which appear redacted, and evaluated “the relative merits” of different candidates, organized them in “order of preference” and debated who would “work well together.”

The agency played a “central role” in this process after being “deeply involved” in the drafting of PROMESA. The list of names “evolved over time and took numerous forms.” It wasn’t until “near the conclusion of the selection process,” according to the Treasury, that a schedule was outlined to consult with congressional leaders about their lists of candidates, evaluate the ethical compliance of these individuals, and officially announce the appointments to the Board.

The names of the first seven members appointed, including those associated with the Republican Party, were already on the Treasury’s radar as candidates for the Board before the law was passed. Some candidates, such as current president David Skeel, had a relationship with the Treasury group that has worked on the Puerto Rico issue since January 2016.

The Treasury team’s ‘framing questions’

On July 7, 2016, Treasury Secretary Jack Lew led the “PR Staff meeting”, a meeting with his staff in which they discussed the selection of members for the Board and the launch of its operations.

The group that worked on the Puerto Rico issue included Antonio Weiss, Kent Hiteshew, Adam Chepenik, Glen Sears, Laurie Richardson, Randall DeValk, Brad Setser, Anthony Vitarelli and Sam Valverde. Chepenik became one of the Board’s main advisors from the private sector a year later, as an employee of the firm Ernst & Young. The firm also recruited Hiteshew at that time, who has worked on issues related to Puerto Rico. In the case of Weiss, he has participated in discussion panels and published papers about PROMESA (one of them with Setser).

During that meeting, which according to the Treasury was when a formal process was established to select and appoint members of the Board, the group first reviewed its timeline to complete the process, followed by four guiding questions — “framing questions” — that would guide the evaluation of candidates: whether the candidates were “associated with Puerto Rico,” whether they lived on the island or in the diaspora; what role “outside stakeholders” would have in the selection process; what should be the general perspective among the candidates to “balancing the competing equities” with PROMESA; and how to manage conflicts of interest, and if any arose, which ones could be waived.

This document was one of two identified by the Treasury as best describing the criteria it followed in selecting Board candidates. The second is an en email with questions for banker José Ramón González, then a candidate for the Board: which task should be the Board’s priority; how should the Board treat pensions; what type of expertise its members should have; what is the best way to ensure a sustainable level of debt and how much work time could he dedicate to the Board.

“What steps should the Board take in the early going to establish credibility, including the many Puerto Ricans who view the Board as a neo-colonial takeover of Puerto Rico's self-governance? Would you encourage the Board to be as transparent and accessible as possible?” is another of the suggested questions. The answers to the questions are not included in the documents produced to the CPI.

At the July 2016 meeting, they also discussed possible names for Board’s members, with a list of candidates that, in addition to the names, had data on their relationship with Puerto Rico, gender, expertise, conflicts, background and source of their recommendation.

The last item on the agenda was to discuss how the Treasury would provide “technical assistance” in the implementation of the Board in Puerto Rico.

Third public meeting of the Fiscal Control Board, held in Puerto Rico. The first two public meetings were in New York.

Photo by Juan Costa | Center for Investigative Journalism

On September 6, 2016, a week after being appointed, the Board requested “technical assistance” from the Treasury, under section 104(c)(1) of PROMESA. In addition to requesting an example of bylaws to use as a reference for the Board, the email specifically mentions six points: the PROMESA law, the government of Puerto Rico’s budget and structure; public debt, liquidity, credit unions, and “an update of the personnel and firms hired so far by the parties involved in matters related to PROMESA and the work of the Board.”

The Treasury sent bylaws and organized an onboarding meeting for Board members.

In addition to the selection of members, work plans at the Treasury related to the Board included collaboration with the federal General Services Administration (GSA), possible hiring and staffing for the Board, the drafting of its bylaws and regulations, and training on PROMESA to members. The Fiscal Plan was also on the agenda, and how it would address pensions and the credit unions sector, and preparation for the litigation that PROMESA would bring. In the “other” category were external communication plans and how to involve stakeholders in Puerto Rico and the diaspora.

U.S. Department of the Treasury, in Washington D.C.

Photo taken from Visualhunt.

The ‘final list’

By July 25, 2016, the Treasury had a list that identified all the original members of the Board, except for García. A “final” list showing six of the seven candidates who were named circulated on August 22, 2016. García does not appear in this document, which includes two names that are redacted: a Republican nominee and a “backup” Republican nominee.

Along with Carrión, García was one of the final six candidates recommended by then-House Speaker Ryan. The latter shared his candidates with the Treasury since at least May 16, more than a month before PROMESA was approved. “Not [a] bad point of departure,” Weiss wrote of Ryan’s list, which already included García

García and Carrión, both Puerto Ricans, resigned from their positions in the summer of 2020. Shortly after, then-President Donald Trump appointed Justin Peterson and John Nixon to these two chairs. Peterson resigned last August, and his seat remains vacant, while Nixon remains on the Board.

The other two Republican appointees to the first Board, Biggs and Skeel, came from Senator McConnell’s office. In the case of Skeel, who has chaired the Board since October 2020, he already had a previous relationship with the Treasury group, since at least early 2016, emails show.

Trump renominated Skeel in January 2021, after doing the same a month earlier with Biggs.

On the Democratic side, a list shared in emails on July 5, 2016, classifies candidates among “original,” “additional,” and “considered but not selected.” The document identifies among the redacted information the names of Arthur González and José Ramón González as “original” candidates, and that of Ana Matosantos among the “additional” ones.

Matosantos, who is an expert on budget issues, was recommended by the National Governors Association (NGA), a political organization that brings together U.S. governors. In the case of Arthur González, the former bankruptcy judge was on a list shared by Rep. Nydia Velázquez with Nancy Pelosi, according to an email from Antonio Weiss.

That same day, another list of names circulated that had the support of the American Federation of State, County & Municipal Employees (AFSCME), the Service Employees International Union (SEIU), and the American Federation of Labor & Congress of Industrial Organizations (AFL-CIO). The names of those recommended are redacted. These unions have represented and negotiated on behalf of their subsidiaries in Puerto Rico as part of the bankruptcy process under Title III of PROMESA which affects the rights of government employees and retirees.

Other emails show that both then-governor Alejandro García Padilla and the now-governor and then-Resident Commissioner, Pedro Pierluisi, also submitted names to the Treasury.

John Laufer, Pierluisi’s chief of legislative affairs, wrote to a Treasury official: “This [list] was prepared by others in my office — the Congressman [Pierluisi], CoS [chief of staff Maí Vizcarrondo], smart folks in PR — and so I cannot vouch for it personally.”

As with the rest of the documents, the names of people recommended by the resident commissioner’s office are redacted.